Contract Questions

What should you not do when you are under contract?

While you have a property under contract, your credit and income will be under review if you are seeking financing. For this reason, you should not do anything that will change your income stream, credit score, or debt-to-income ratio. Avoid:

- Quitting your job

- Changing jobs

- Deciding to become self-employed

- Making a big purchase like new furniture or a vehicle

- Taking out another loan on anything

- Falling behind on all payments, including your utilities

- Spending the money you have saved for closing.

If you plan to make a large deposit into an account–such as gift money for the home purchase–be prepared to provide additional documentation to the loan officer.

Can you outbid a house under contract?

Once both parties sign a purchase and sale agreement, it is a legally binding agreement. Getting out of the contract requires buyers and sellers to adhere to the contingencies and stipulations.

That doesn't mean houses don't fall out of contract. They do all the time, as detailed in our 10 Ways A House Can Fall Out of Contract.

You could extend an offer to a home under contract, but the seller must have inserted terms that enable them to continue to accept offers. In this scenario, the other buyer may be allowed to match or exceed any higher offers.

Sellers could also accept back-up offers, as long as it has the Addendum for Back-Up Contract included. In this scenario, the seller cannot compel the first buyer to waive the contingency or terminate the contract under the addendum until the seller accepts a written offer to sell the property.

Can I get out of a loan once it is under contract?

You can, but it must be because one of the contract contingencies isn't met. A prime example is if the appraisal comes in too low to justify the price.

Depending on the reason for backing out, you may or may not get the earnest money deposit. If you do end the contract because of a reason not covered by contingency or due diligence period, the buyer loses their deposit. The seller could also sue the buyer to force the sale.

How many home contracts go to court?

It's hard to find specific numbers about the number of residential contract cases that go to court; the figures could also fluctuate each year.

When buyers and sellers disagree, the Purchase and Sale Agreements contain provisions for dispute resolution. These include:

- Arbitration: The buyers and sellers work with an arbitrator–not a court officer– who decides the matter. Binding arbitration means both parties are bound by the award and not entitled to a court review of the decision, except under limited circumstances.

- Meditation: In Texas, the most used contract is the One to Four Family Residential Contract (Resale). This contract uses mediation for dispute resolution. A neutral third party works with the buyers and sellers to find a mutually agreeable solution. Costs for mediation are split evenly between the buyer and seller. If mediation fails, the matter may move to the court system.

- Civil Courts: If a Texas real estate contract needs to go to court, the precise language is to file in a "court of competent jurisdiction," which is often a county civil court. At this stage, you will want the advice of a real estate attorney.

How to sell your home while under contract?

Home sellers can accept back-up offers and continue showing their home as long as they have a supplement for a "back-up" contract that enables them to entertain second offers. This addendum makes termination of the contract dependent upon the failure of the first contract to close. Consult with your real estate professional if this is something you are interested in entertaining.

How long can a house be under contract?

Buyers and sellers can negotiate their days to close as part of their purchase and sale agreement. Delays in obtaining financing, scheduling property inspections, and buyers accommodating seller requests can unexpectedly push back a closing date. For this reason, and many others, there isn't a set time limit for how long a house can be under contract. For a purchase and sale agreement to be terminated, it has to follow the contract terms; otherwise, the home can sit in purgatory.

Should my spouse be on a real estate contract in Texas?

Texas is considered a "community property" state. When two people live together in a home, even if only one has their name on the title, that second person has homestead rights.

Property bought when two persons are married is considered community property, making both of them joint owners requiring dual signatures at closing. Even if you have a prenuptial agreement as justification for not having a spouse sign at closing, the title company will still have the spouse sign a consent to the sale of their homestead.

Because of Texas's community property nature, we typically require both spouses to sign the listing agreement and the contract as a measure of terminating homestead rights for both spouses.

Real Estate Taxes

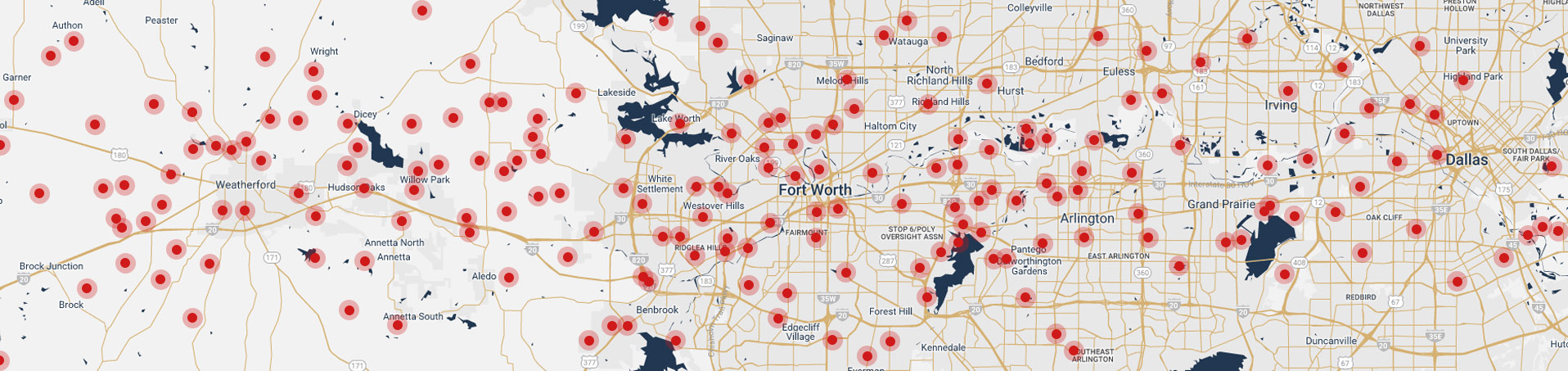

Where can I find the lease property taxes in Fort Worth?

Find the most up-to-date information about Fort Worth property taxes at the Tarrant County tax collector website. Property taxes vary according to where your property is located.

What are Fort Worth property taxes?

Your Fort Worth property taxes will vary based on where your property is located. To see the most recent information about property taxes, type in the address at the Tarrant County Property Tax Division website.

To give you some idea of the variation in tax rates, in 2019, an Arlington property inside the Arlington Independent School District had a 2.72% tax rate. Meanwhile, a Fort Worth property inside the Fort Worth Independent School District had a 2.87% tax rate. Everman had the highest property tax rate in 2019, at 3.45%.

Is there a mortgage, transfer, or other tax imposed on Texas real estate transactions?

Texas has no mortgage or transfer taxes on real estate.

Housing Questions

Why are multifamily houses rare?

Multifamily houses and their supply have to do with real estate demand. Most people are looking for single-family housing, so that is predominantly what is available in the market. That makes finding a multifamily home challenging on its own.

Multifamily properties are also in high demand by real estate investors because of the potential rental income available. Investors are aiming to make appreciation gains, so they typically buy and hold properties for years. This further impacts the available housing stock in this niche.

When is the best time to buy in Fort Worth?

It's never really a wrong time to buy in Fort Worth. Each time of year will have its advantages and disadvantages. Indeed, real estate transaction activity is typically more in the spring and summer months.

One report says that the optimal time to buy in Fort Worth is January because the median home prices tend to drop compared to the summer months.

However, in the summer months, inventory typically goes up, which will give you more options during a home search.

It really depends on your goals for the transaction. If you're looking to save money, search in the winter. If you want more options, look during the summer.

Should I sell my current home before buying a new home?

That depends on your situation. Selling a home before buying another house is a practical solution for gaining access to capital. You'll have the down payment and/or full funds available to speed up the closing process. Selling first also prevents you from putting a home sale contingency on your next house's contract and the stress of hoping you find a buyer in time.

However, selling first often requires temporary housing, which can increase your expenses temporarily. You may need to put your belongings in storage for an indeterminate amount of time as you look for your next dream home.

Consult with your real estate professional about the real estate market. If your current home is in a high-demand area, that may give you more confidence that your home will sell in a timely manner if you have to put a home sale contingency in your purchase and sale agreement on your next home.

First-time Home Buyer

What's the first step in buying a home?

Congratulations on your interest in becoming a homeowner. Your home buying process starts with determining your long-term financial goals and how homeownership plays a role in those goals. You also want to consider your career in your personal goals as part of deciding if homeownership is right for you.

Take some time to answer these questions:

- How is your financial situation? Look at your savings, credit score, and income stream.

- Which home type will best suit your needs? Look at townhomes, condos, and single-family real estate.

- What features do you want in your ideal home?

- How much mortgage could you qualify for?

- What is the maximum home value within your budget? This includes looking at your debt-to-income ratio and budget.

- Who will help guide you through finding and purchasing a home?

Do I need to be pre-approved before looking at houses?

You don't need to be pre-approved to look at real estate, but if you are serious about purchasing a home, you need to talk to lenders and work on getting pre-approved so that you can put down an offer fast when you find the right home.

Should I buy or continue renting?

The decision to buy or keep printing is a personal one and different for everyone. Owning real estate can be a good investment but can also lose you money in some situations. You will want to look at your finances and future plans to determine if renting or buying is right for you.

Generally speaking, to break even with a home purchase, you should plan to stay in the property for a minimum of three years. This will be different for every person and home purchase, but it is a starting guideline to help you figure out what is best for you.

One of the benefits of choosing to buy real estate is your mortgage payments will help you build some equity in the property. You'll be able to customize your living spaces and enjoy the stability of homeownership. There are no landlords who might decide to sell the home or stop renting the property.

What costs are associated with buying a home?

In addition to having an earnest money deposit available in funds for your down payment, purchasing a home comes with transaction closing costs. These costs can include:

- Appraisal fee

- Home inspection

- Pest inspection

- Loan application fee

- Origination or underwriting fees

- Credit check fee

- Title insurance

- Title search fee

- Property taxes

- Property insurance

- HOA fees

How many homes should I look at before buying?

There is no magic number for how many homes you should view before making a home purchase. Research from the National Association of Realtors finds that buyers typically look at around ten properties before extending an offer. That doesn't mean it's a right or wrong number for you.

A true real estate professional will look at as many properties as necessary to help you feel confident and one of the most significant decisions you make.

You can take some steps to help yourself feel better during the home search process and to help eliminate houses that aren't right for you. Look at the potential neighborhoods you are interested in buying. Physically drive through them to see if the homes in the area or worth your time touring.

When you begin the home search process, determine your budget. Look online at the homes that fall inside your price point. Get a realistic sense of what you can afford. Then you can come up with a few non-negotiables and be willing to compromise uncertain features of a home.

What is an earnest money deposit (EMD)?

An earnest money deposit, also known as a good faith deposit, are funds that you put down with your purchase and sale agreement to show the buyer you are serious about the transaction. The earnest money is a way of protecting the seller in case you back out of the deal. A typical amount is 1 to 3% of the sale price. The funds will be held in escrow by a neutral third party until you close the deal. The funds typically get applied towards your down payment.

How long does a seller have to respond to my offer?

We consider up to three days a standard expiration date across the real estate industry, although in most cases, responses are given within 24 to 48 hours.

What's involved with making a property offer?

Once you find a property you would like to buy, you will consult with your real estate agent. Together, you will decide the terms of the deal. The real estate agent will write the offer letter and send it to the seller's representative.

The seller has three options once they receive your offer. They can choose to accept all of the terms in your offer. Most commonly, sellers will extend a counteroffer changing some of the terms to be more favorable to them. Or, they can not respond at all and choose not to accept your offer.

When you have a counteroffer, there is no set number of times that you go back and forth. It's merely a negotiation where both parties are coming to a mutually beneficial agreement. If you do come to terms, both parties will sign the purchase and sale agreements, and you will be under contract.

Working with Real Estate Agents

Do I need a real estate agent to buy or sell a home?

Homeowners have the right to sell their real estate themselves. In the industry, we call this For Sale by Owner (FSBO).

Selling or buying your house yourself might seem like a great deal, but reports show using a real estate professional actually nets you more of your home's value.

How can a real estate agent help my home sell?

A real estate agent will be your guide and make sure your home sale nets the most value possible. We help you determine the list price of your home. Our training enables us to market your home to targeted buyers effectively. We list, advertise and coordinate home showings with prospective buyers. Once you have an offer, we help you evaluate all received offers and negotiate the terms with the buyers.

What is dual agency?

Dual agency is when a single real estate agent represents both buyer and seller. As a result, they keep the full sale commission. It can also happen when real estate agents from the same brokerage represent the parties in the transaction. Texas law dictates that if a real estate broker represents buyer and seller, the broker must act as an intermediary.

What are the benefits of having a buyer's agent?

Deciding to use a buyer's real estate agent will save you a lot of time and money. Your buyer agent will help you find listings that suit your budget in style. They will tour the properties with you and point out things you may not have necessarily noticed. They will also scout the market to get in first to properties that might interest you the most.

When the time comes to extend an offer, your buyer's agent will help you understand all the terms of the contract. They will be your partner in the negotiation and help you understand your options if the seller comes back with a counteroffer. Real estate agents are powerful negotiators prepared for any hurdles that may come your way.

Does the law require a buyer representation agreement?

According to the Texas Association of Realtors, it is not required by Texas law to sign a buyer's representation agreement. Many brokerages do require their agents to obtain signed agreements before a real estate agent can submit an offer on a buyer's behalf as a way of covering their liability and their commission.

How long does a buyer representation agreement last?

The length of a buyer representation agreement can vary. However, a typical contract lasts for six months, sometimes by representation agreements lasting for 30 days, while others can last for up to a full year.

Does law require a seller representation agreement?

According to the TREC, a listing agreement is a private contract between a real estate broker and a property owner. It is not required by law, but we do use listing agreement forms to spell out the work that is to be performed and cover our liability.

How long does a seller representation agreement last?

The length of a seller representation agreement varies according to the terms of the contract. A listing agreement can last for three months, six months, a year, or anything in between. However, six months is the most common length for a listing agreement.

Home Ownership

Do I need title insurance?

If you are financing the home purchase, the lender will require you to purchase lender's title insurance to protect their claim to your property and its value. Owner's title insurance is optional but recommended as a way of protecting your claim to the deed.