The high-performing economy in the Dallas-Fort Worth metroplex attracts more than job seekers. Employment growth attracts businesses, which translates to more opportunities for commercial real estate investment.

Nationally, U.S. commercial real estate averages a return of 9.5 percent as of June 2018. Of course, actual returns vary by region, property class, and investment strategy. For example, the North Texas region performs well in industrial real estate and manufacturing.

A commercial real estate investment is an excellent way to generate income or diversify a portfolio with the right strategy and background knowledge. Unlike the stock market, whose performance varies wildly even from day-to-day, real estate is a finite resource. It tends to hold value even in a down market. Certain real estate subclasses, like self-storage or grocery-anchored shopping centers, traditionally do well in recession markets.

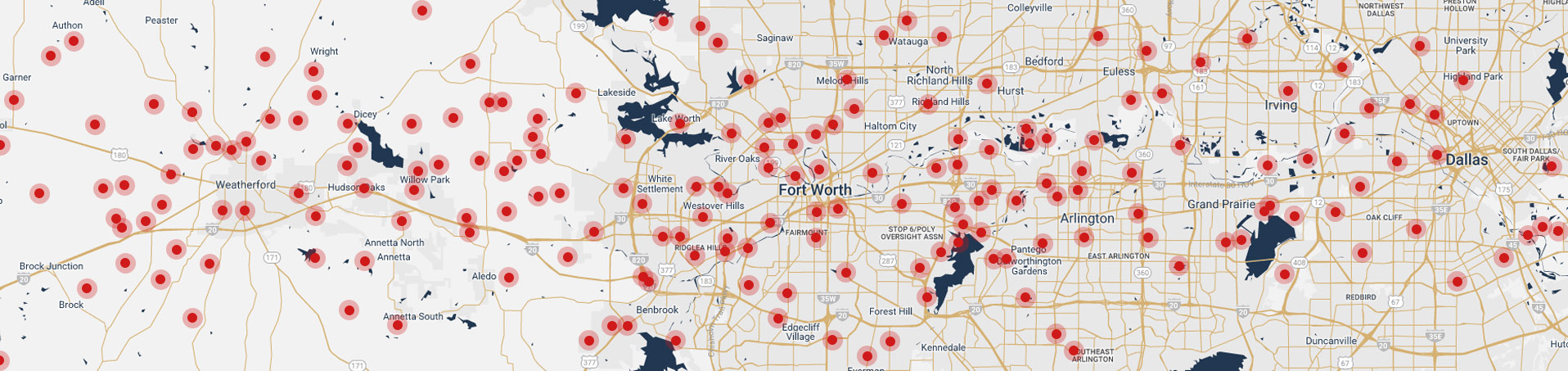

Fort Worth’s commercial real estate investment opportunities vary widely, but interested investors can find the right deal is every subgroup of commercial properties. The information contained here reflects more current market trends.

Starting with commercial real estate investing

Are you exploring commercial real estate investing for the first time? The attraction is obvious: portfolio diversification, risk-adjusted returns, and a potential income source. Commercial real estate ownership provides returns in two ways: first, in leasing the property to tenants, and second, in the property’s appreciation over time.

Owners create income by leasing properties at the right rate. Location is crucial to a business’ success, and the same is true for commercial property ownership. Multifamily spaces are more likely to command higher rental rates when positioned near high-demand urban centers than a similar multifamily complex positioned ten miles away.

Appreciation is why commercial real estate ownership is a long-term strategy. The longer you hold the asset, the greater your appreciation gains will be when it’s time to sell. Of course, this requires maintaining the property in an attractive, operating condition. Even commercial assets can lose value over time. Total appreciation gains depend on economic factors, market conditions, and property conditions at the time of sale. Real estate investors guard against loss by budgeting for improvements that add value to their commercial real estate assets over time.

Each property subclass offers advantages and challenges. For example:

- This includes warehousing, distribution centers, and manufacturing buildings. A warehouse or distribution center located near an urban hub could be easy to attract a tenant. Lease lengths tend to be longer. Nationally, industrial real estate is in high demand with some markets reporting record low vacancy rates. National Real Estate Investor ranked Dallas-Fort Worth second on its list of best-performing markets based on absorption.

- This includes office parks, office skyscrapers, and standalone buildings. Office space is another area disrupted by a changing workforce. Leases are trending shorter, smaller spaces are in higher demand. The expansion of coworking and shared spaces impacts the office leasing market. Office tenants could be startups or an established firm. Space may linger on the market longer waiting for the right tenant.

- Multifamily. Typically, this means apartments, but it includes student housing, senior housing, or condominiums. Leases for apartment buildings typically are shorter term. The risk for severe damage due to tenant incompetence is higher. The more units at the property, the more accounts to manage, maintenance to tackle, and marketing expenses for vacant units. You’ll need to be ready to evict problem tenants or budget for tenants who break leases early.

- This includes shopping centers, malls, or stand-alone retail buildings. Nationally, retail centers have struggled as consumer shopping habits shift online. This isn’t necessarily true in every case, and some North Texas shopping centers are finding ways to thrive in a disrupted environment. However, investors should view retail as having a greater risk.

Understanding the different property classes available and their challenges, how can you minimize your commercial real estate investment risk?

- Understand your greater regional market and your submarket, which we will do specifically for Fort Worth below.

- Conduct due diligence about the commercial property and investing.

- Go into the commercial real estate purchase with an exit strategy in mind.

- Understand how commercial real estate properties are valued differently from residential.

“The success of two residential properties right next to each other is typically similar, while commercial buildings in a similar position could fluctuate independently, so it's important to understand the range of risks inherent to your potential investment.” - Nav Athwal, RealtyShares, to Forbes Magazine

Learn how to assess the market and an asset’s potential risks to make sure it meets your financial goals. If you can solidly grasp the fundamentals surrounding a commercial real estate investment property, you increase your chances of securing a solid investment with good returns.

Now, let’s detail what you need to know about the Fort Worth commercial real estate market.

Fort Worth Real Estate Investing: Overarching Market Conditions

Regardless of the property class, savvy investors track a region’s population growth and job market. Texas’ population grew 10 percent over the past five years. Even as other urban centers reported a cooling in population growth, projections show the DFW’s population and employment growth should remain steady in the near future. People need places to work, live, and be entertained, which is a plus for commercial real estate investing.

Overall improvement to the national and state economy boosted economic and confidence indexes. The Texas Consumer Confidence Index rose to 5.8 points after leveling off in July and August 2018, buoyed by the healthy economy and labor market.

Fort Worth offers a pro-business environment. It’s one of the factors driving the population boom in the Dallas-Fort Worth metroplex. More and more people choose to call North Texas home because of the available positions. One source noted DFW tends to lure talent in the higher-paying finance, computer, and consulting industries.

Real estate investors ranked DFW second in terms of investor interest, right behind Los Angeles and Southern California in a May CBRE survey titled “Americas Investor Intentions Survey 2018.” Nearly half of the survey’s respondents cited the region’s strong economy as driving rental growth.

Foreign investors want markets with high growth fundamentals, like Dallas-Fort Worth. For example, Canadian-based investors were responsible for $326.2 million alone from May 2017 to May 2018. John Alvarado, Senior Vice President, CBRE Capital Markets’ Institutional Properties, said, “This trend should benefit Dallas, which remains as one of the nation’s highest growth markets. Our on-the-ground experience so far this year confirms an uptick in interest by first-time [CRE] buyers in Texas.”

In the third quarter of 2018, 34 percent of the jobs added in the DFW metroplex were attributed to the industrial sector. Keep in mind that two-thirds of the state’s new jobs were in healthcare, the energy business, and computer expertise.

Fort Worth Industrial Real Estate

Nationally, industrial real estate attracts the highest investor interest. North Texas aligns with that trend. A Bizjournal report found industrial real estate attracted the most in investment dollars.

Let’s dive deeper into the local industrial real estate submarket. National Real Estate Investor ranked Dallas-Fort Worth second on its list of best-performing markets based on absorption. Vacancy rates remained stable across DFW, with the third quarter reporting a 6.7 percent overall vacancy rate for Fort Worth.

Demand continues trending high, and even as new industrial spaces become available, leasing activity is robust. Cushman & Wakefield is tracking 19.1 million sq ft of new industrial space under construction, with 41 percent expected to come to market by the year’s end.

Experts consider DFW’s outer submarkets ripe for industrial development but are facing talent and labor shortages. There is more space available away from Fort Worth’s urban core, and developers do get more returns outside the traditional market. For instance, industrial properties in West Fort Worth commanded an asking lease rate of $7.33 per sq ft.

Recent cap rates for Fort Worth industrial real estate reported as:

|

|

Low |

High |

|

Class A |

4.50% |

5.25% |

|

Class B |

5.50% |

6.25% |

|

Class C |

7.00% |

8.25% |

Ridgemont Commercial Construction Director of Office and Industrial Damon Norman told Bisnow there’s a movement towards “future-proofing” industrial real estate. This future-proofing helps gives tenants room to grow and flexibility when later selling an industrial space. He specifically cited a trend toward increased clear heights and space conversions for mezzanine storage.

Fort Worth Office Real Estate

Job growth in Fort Worth has been steady, reaching three percent annually. Demand varies quarter over quarter, based on new properties coming online, corporate relocations, and varying unemployment rates.

From October 2017 to September 2018, 30,000 new office jobs were added to this submarket. Business and professional services account of 62 percent of jobs in the office sector.

Over the last year, rental rates for Class A office properties grew 5.9 percent by the end of 2018’s third quarter. Class A’s net absorption rate outstripped Class B properties. According to JLL, companies competing for top talent use office space as an amenity, making Class A office space in higher demand.

The Central Business District (CBD) remains a top office space market despite XTO Energy’s departure. Vacancy rates may have increased in this market, but Class A buildings in CBD still commanded $30.76 per sq ft in the third quarter. West Fort Worth was the most affordable market for Class A office space at $24.80 per sq ft.

Total office vacancy for DFW increased to 18.8 percent year-over-year by the end of Q3 2018. Compare to Fort Worth’s vacancy rate of 14.6 percent. The overall lease rate for all office classes was $25.29 per square foot. Around 770,000 square feet of office space is slated to be completed by the end of the year.

Recently reported cap rates for Fort Worth office real estate stood as:

|

|

Low |

High |

|

Class A |

6.25% |

7.25% |

|

Class B |

8.25% |

10% |

|

Class C |

9.25% |

12% |

Coworking is a trend to keep an eye on. Local shared space providers like PinnStation Coworking are expanding their footprints while existing building owners see it as a way to generate revenue for underutilized spaces.

Multifamily Real Estate

This category covers subclasses like affordable housing, student housing, senior housing, and traditional apartment complexes.

The DFW metroplex is the fourth largest in the United States and one of its fastest growing. Translation: all forms of housing are in high demand, including multifamily. Single-family housing isn’t able to keep up with the current demand.

Conventional multifamily properties currently perform well in Fort Worth. Occupancy rates stood at 91.9 percent with an average asking rent of $1.25 per sq ft as of August 2018. Multifamily absorption remains positive and experts expect this to continue for several years.

The Multifamily Annual Report 2018 notes northwest Fort Worth is an activity hotspot with 4500 units under construction in 2018. In total, Fort Worth is expected to have 7,100 new multifamily units added during 2018 and into 2019.

Central Fort Worth had the most new units under construction or planned, at 3,622. The Grapevine area was next, followed by North Fort Worth and South Fort Worth. Some of this development ties into larger projects, like the Trinity River Vision Project, and Arlington's 100 Center and 101 Center.

Even with the new development, demand for multifamily housing is helping support a steady increase to area rental rates.

Recently reported cap rates for Dallas-Fort Worth multifamily infill real estate stood at:

|

|

Low |

High |

|

Class A |

4.5% |

5% |

|

Class B |

6% |

7% |

|

Class C |

5.75% |

6.25% |

Drilling down into Fort Worth, Integra’s 2018 annual report reported Urban Class A cap rates for Fort Worth as 5.3 percent and Suburban Class A at 5.5 percent. Asking rents for an urban class A averaged $1,780. Integra predicted a 4 percent increase in value for urban and suburban multifamily properties, Class A and B, during 2018.

Senior Housing

In the 2010 census, around six percent of the US population was over 75 years old, and projections significantly grow those numbers. The increased investor interest in senior housing is due to an overarching national market demand driven by an aging population.

Senior housing represents only six percent of Fort Worth’s total multifamily market, but the DFW area ranks in the top 10 for average annual growth of its 65+ population. By the end of August 2018, 86.4 percent of the available 12,607 units were occupied.

Seniors tend to seek housing close to their families and lifestyle amenities. A report from Bisnow says the construction trend is towards for-profit luxury senior housing, but different strategies abound. There could be room to grow in less obvious places for senior housing.

Student Housing

Student housing represents three percent of the Fort Worth multifamily market with 39 properties as of August 2018. These have an occupancy rate of 85.3 percent. Nationally, the volume of new student housing supply has consistently delivered more than 45,000 beds since 2015. However, it’s unclear where these new units are being delivered.

Retail Real Estate

Fort Worth added 4,800 new retail jobs in 2018’s third quarter, its lowest increase over the last two years. It’s not an anomaly. Dallas retail hiring slowed, and the trend appears across the nation.

However, the retail market is performing relatively well in the DFW metroplex. At mid-year 2018, occupancy rate stood at 92.5 percent despite major store closings. Over 3.5 million square feet of new space is slated to come online during the year, says Bisnow.

The closure of big name brands weighs heavily on the market, but overall big-box vacancies stood at 110 properties, which is less than in 2009 and 2010 when over 250 big-box locations stood empty.

Shifting trends means 2018 has been the year for redeveloping and breathing new life into older properties. Experience-centered retail centers play well with consumers and draw foot traffic. More mixed-use developments include retail components to appeal to the live-work-play lifestyle of urban cores.

As of Q3 2018, Fort Worth’s overall occupancy rate stood at 94 percent, which was down year-over-year by 0.6 percent. The absorption rate was 32,349 sq ft. In central Fort Worth, the occupancy rate was reported at 94.5 percent in the same quarter, but with negative absorption of 36,708.

Making a Commercial Real Estate Deal?

No real estate investment is without risk. Commercial real estate is not an exception. Your best bet at succeeding in Fort Worth commercial real estate investing is finding a motivated seller who is willing to negotiate.

Additionally, find a team centered around building relationships with property owners, potential tenants, and industry-related service professionals. The right real estate agent is a crucial part of your investment decision-making team. The Chicotsky Real Estate Group knows commercial real estate deals take time, and you need an experienced professional at every step of the journey.

We encourage you to keep researching the Fort Worth area and following market trends. Please contact us for the latest in Fort Worth real estate.