Buying your first home is a huge milestone. For most people, a home is the most significant item they will purchase during their lives. Homes aren’t bought on a whim; they are an investment made after months of deliberation and preparation.

Since first-time home buyers have never transacted real estate before, there is a learning curve. The real estate industry has a specific process for transferring property ownership born from a need to reduce fraud and protect all parties involved. Home buyers must learn how to successfully navigate that process.

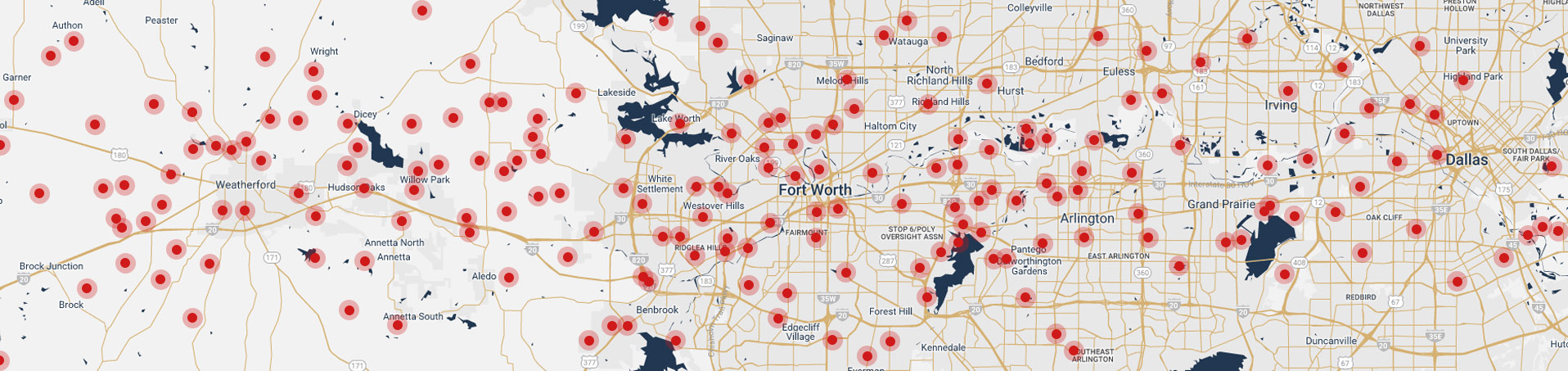

Today we tackle what first-time home buyers need to know about buying their first home in Fort Worth.

The Benefits of Home Ownership

Home ownership is the cornerstone of the American dream. It represents stability and security to our society. Owners become invested citizens in the places they live.

Financial benefits begin with the predictable costs of ownership, which help with personal budgeting. The interest and property tax portion of a monthly mortgage payment is tax-deductible. Over the long-term, real estate is an appreciating asset. Owners expect their homes to gain in value and build equity. The Federal Housing Finance Agency (FHFA) House Price Index (HPI) reported U.S. home prices rose an average of 34.71 percent over the five-year period ending Dec. 31, 2017. Rising prices make owning a home one of the better long-term investments you can make. The longer you stay in your home, the more you stand to gain.

When owners do sell the home, federal law allows most homeowners to keep the profits and pay nothing in capital gains taxes. Tax law can change, and there are stipulations, like having owned the home for at least two years. Look at the requirements here.

Emotionally, there’s a certain amount of pride in being able to say you are a homeowner. The space is customizable to your needs. You become invested in your community. Home owners are more likely to vote in local elections and participate in civic groups.

Finally, home ownership affords a sense of privacy that doesn’t exist in multi-family style living situations like apartments or duplexes. Some people value their space, and home ownership is how they find a space of call theirs.

Should you become a homeowner?

The truth is home ownership isn’t for everyone. Homes come with unseen costs to finances and your time that not everyone anticipates. It’s not uncommon for new homeowners to say owning the home was more work than they thought it would be. Why is that?

- When there’s a problem, there is no property manager or landlord to call. That pesky squirrel in the attic is your problem to remove.

- To stay habitable and safe, all homes and their hardware need routine maintenance. Water heaters, HVAC systems, refrigerators, stoves, and smoke detectors have life spans. But it’s not just hardware. Life happens. A window is cracked after the lawnmower throws a stone into it; termites appear; the basement floods. The owner tackles these issues.

- Hidden costs. Maintenance items have a price tag. Even if you do-it-yourself, you’ll spend a few hundred dollars each year on your home. Think about the small stuff: caulk for the bathtub, gas for the lawnmower, chlorine for the pool, sealant for the deck. It all adds up.

That said, there are some perks to owning your slice of the American dream. But should you take the plunge?

If you want to own a home, you should:

- Plan to stay in the area you want to buy for several years. If your occupation or family needs mean you’ll probably be moving soon, don’t buy.

- Have enough saved for moving costs. Moving is expensive, even if you rent a truck and load your stuff. There’s hidden fees in starting and stopping utilities, making repairs, and buying new furniture to fit the home.

- Have a strong financial situation. By that, we mean enough for a down payment and stability in income to afford monthly payments.

The types of housing

Homeownership breaks down into these types of housing units:

- Single-family home: a detached residential unit on its own property. It does not share property boundaries, roofs, or walls with other properties. You own the land and home.

- Condominium: a shared living situation where you own the individual unit but share common spaces like walkways, elevators, parking, and amenities. Read about buying a house versus a condo.

- Duplex/Triplex/Fourplex: a multi-family living situation where you can own one unit and rent the other(s). These residential buildings have walls and roofing structure shared with other units.

- Townhome: Typically, a tall, narrow, traditional row house. Usually multi-story in layout.

Where to begin buying a home

1- Your finances

A realistic place to start is with getting your finances in order. This must happen well before you seriously start the home buying process.

Understanding your finances is an important and healthy step in your process. For many, this process of buying a home is the first time they deconstruct their spending and financial situation. It can be a wake-up call or good news. Either way, everyone should know where their hard-earned money is going.

Buying a home is a major expense. Nearly all homebuyers need saved funds to complete a purchase. Even if they qualify for a no-down payment mortgage, there’s still closing costs and moving costs.

Assess how much money you have saved or want to save. Dipping into emergency reserves to fund a home is not recommended. This is why running your numbers is crucial before starting the buying process. You might need to save for a few years before achieving your goal amount.

Another reason? Your credit score. Mortgage lenders use this number to help determine how much financing you qualify for. Better credit scores get better rates. Changing your credit score takes time. Pulling your annual free credit report copy gives you time to clear up any issues and improve your credit score. These reports often come with tips to boost your numbers.

2- Can you afford a home?

How will owning a home change your monthly budget? Remember, as a homeowner you will pay additional fees beyond the mortgage payment and these increase over time. We’re talking about mortgage insurance, property taxes, and homeowner association fees. Yes, taxes and insurance rates change year-to-year, meaning your mortgage payment will rise.

You’ll likely be putting some funding down, whether it’s 3 percent or 20 percent. Putting less down means you’ll have a higher cost over time and need private mortgage insurance to secure your loan. This impacts your price over time.

Factoring in costs for maintenance, utilities, and cleaning.

The general rule is housing costs should not exceed 25 percent of your income. If your take-home pay is $4000 a month, this means your mortgage payment, association fees, and utilities should not be more than $1000.

Plenty of affordability calculators predict how much home you can afford. Just remember these are predictions. It’s always best to be conservative with your budget and home purchase.

The Actual Home Buying Process

This process starts after you’ve done work on straightening your finances and checking your credit score. We assume by this point, you have an idea of how much home you can afford.

#1- Meet with mortgage lenders

Don’t meet with one and call it done. Interview several. It’s like shopping for a car: who’s going to give you the best program for the best rate? Ask what they can offer you. Don’t let them run your credit unless you’ve committed to working with them. Too many credit runs negatively impact your score.

Once you’ve picked a mortgage lender, get pre-qualified for a loan. This shows you’re a serious buyer and tells you how much home the bank will finance.

Gather paperwork the bank requires to secure the loan: financial statements, pay stubs, tax forms. Start keeping track of these once you get serious about house shopping.

#2- Hire a Real Estate Agent

A great real estate agent is your best resource in this home buying process. They’ll talk about your needs and wants in a home and neighborhood. Their expertise will recommend neighborhoods to look and cover what to expect. They’ll find new listings that fit your interests, sometimes before they’re officially listed.

As industry professionals, agents stay in tune with the market. They have access to hyper local data that’s challenging to find on big-brand websites. Agents know when something is overpriced, a hot deal, or fair. Their knowledge gives them insights into market trends, like an up-and-coming community that could be a hot deal for you to buy in.

The best agents will educate you on the market, your neighborhood, and what kind of house might suit you best. They answer all your questions about the real estate process. Real estate agents act as your advocate through the contract negotiation and pending phase. They are a source of professional referrals who can direct you to lenders and home inspectors,

How to find the best real estate agent? Ask for referrals from your friends, family, and colleagues. Read online reviews. Find someone with specialized knowledge, especially if you know you want to buy a condo or you’re looking at ranch property.

#3- Be available to see homes

Some first-time home buyers find their dream home in their first showing appointment day. This is rarely the case. HGTV and other networks make home buying look easy, but sometimes it takes looking at 20, 30, or 50 homes before you find the right match.

That said, you’ve got to be ready to see homes. If your agent calls you about a property coming on the market and urges you to drop it and see it, this means, a) they think it’s right for you, and, b) they may anticipate competition. Make the time to see the home.

#4- Contract negotiations

Once you’ve found a home you really like in your price point, it’s time to make an offer. Your real estate agent will draw up a purchase offer to submit to the seller. They’ll talk over contingencies, like securing financing, and an estimated closing date. Most contracts have sellers counter the offer. Sometimes buyers in competitive price brackets find themselves in a multiple offer scenario. Your agent will advise you how to handle the counter offer, multiple offers, or congratulate you on an accepted contract.

#5- Moving towards close

Your home purchase is now pending. During this time, you’ll secure financing. The bank will appraise the property, and you’ll have the home inspected. The appraisal or inspection may reveal items of concern that require more negotiation with the seller, either for credit or repairs. This is a busy period, so you’ll be talking with numerous parties concerning the home sale. Your real estate agent continues serving as a guide moving you closer and closer to home ownership.

#6- Closing the sale

A day or two before the official close, you’ll have a final walk through. This is your chance to make sure everything in the property is in working order. Do check everything during the final walk through.

You’ll come to the closing table with a check for your closing costs and down payment. Go through the paperwork carefully; as the buyer, you’ll sign plenty of it. At the end of the closing session, you’ll be handed the keys to your new home!

Fort Worth real estate taxes

Texas is one of the few states without a state income tax. The trade-off is higher property taxes, which rank as the third-highest average home property taxes in the United States.

According to Attom Data Solutions, the average property tax bill in Texas was $5,265 in 2018. The average taxes paid on a single-family home in Tarrant County was $5,554.

Tarrant County has one the highest number of property tax accounts in the state. See who the county collects taxes for and the tax estimator link for an address.

The Advantage of Being a First-time Home Buyer

First-time buyers can leverage their status with some special financing and lending programs. Check these out:

- FHA Mortgage Program: Purchase a home for as little as 3.5% down. You will need to carry mortgage insurance over the life of the loan.

- USDA: United States Department of Agriculture (USDA) offers two types of loans to low-income first-time home buyers looking to live in rural areas.

- VA Loan: Available to active service members, veterans, and their families. Purchase a home with no money down.

- Good Neighbor Next Door: Run by the Department of Housing and Urban Development (HUD). Includes teachers and first responders. Get 50 percent off certain homes in “revitalization areas” as long you live in the home for at least three years.

- Fort Worth’s Homebuyer Assistance Program: Provides up to $20,000 in mortgage assistance to income-eligible first-time home buyers inside city limits.

Tips for first-time buyers

#1- Don’t go for broke.

Just because you can afford your pre-approval amount doesn’t mean you should aim for that. The last thing you want is to be “house poor,” where your new home is training your financial and time resources. Your pre-approval is the ceiling. Give yourself some cushion.

#2- Make a budget. Stick to it.

It’s easy to get swept away in a home’s features. A smart real estate agent will never show you a home beyond your means. But just in case: make your budget and stick to the budget.

It can be tempting to go over budget when you’re in a multiple offer scenario. Your financial future is not something to gamble with. Don’t let your heart overrule reason.

#3-Budget for closing costs

These run 2-5 percent of your loan. First time home buyers are shocked to find these costs add up to a few thousand dollars, easy. While you can do some shopping around, like for homeowner’s insurance and home inspections, you’ll still be on the hook for expenses.

Fort Worth neighborhoods to consider

Fort Worth’s neighborhoods have something to offer everyone. It comes down to what you want in your community amenities. This list is just a sampling of what Fort Worth has to offer; your real estate agent will point you to neighborhoods that best align to your lifestyle and price point.

TCU-West

TCU-West is a popular residential neighborhood in Fort Worth real estate for its prime location and proximity to amenities. Areas include Foster Park, Frisco Heights, Westcliff, and Bluebonnet. The construction style varies, with tract houses to ranch-style with two-car garages.

Ridglea Hills and Ridglea West

This community of rolling hills and curving streets is a diverse neighborhood in character and topography. There are shaded streets, green spaces, and a range of home styles. Residents claim Ridglea Hills has a small-town feel.

Arlington Heights

A short ride from the business and cultural district, the residents never have far to go for dining and lifestyle amenities. Historic Camp Bowie Blvd bisects the greater Arlington Heights area, which includes communities like North Hi Mount, Hillcrest, Monticello, Crestwood, and Como.

North Fort Worth

A busy area for development and revitalization. New housing is rising in the blink of an eye. Area Vibes ranked the Far North of Fort Worth as number one place to live in the city. Part of the Alliance Texas development, residents are close to employers and amenities. Pick from the numerous master-planned communities.

Monticello & North Hi Mount

These popular neighborhoods lie close to downtown and its cultural destinations. It has history and style. Monticello is a walkable, well-maintained area with an active neighborhood association.

Colonial Hills

Ths community is near the arenas and sports stadiums around Texas Christian University. Despite being close to downtown attractions and the University, it feels secluded with its established trees and green spaces.

Fairmount

A neighborhood with history and character, part of the National Register Historic District. Residents are close to the city’s top destinations. Many homes have been restored or converted into charming businesses, retailers, and restaurants.

Westworth Village

This is an attractive area with proximity to downtown. It has a bedroom community vibe, having voted down commercialization in the 1950s. The city maintains the area’s natural vegetation and landscape features even as it updates its streets and sidewalks.

Finding your real estate agent

First-time home buyers make many important decisions along the route to their process. One of the most important is right real estate agent. The Chicotsky Real Estate Group are long-time Fort Worth advocates in residential real estate. Learn about buyer’s representation through our group and how we can leverage our experience to make your first home buying experience a breeze.