Curious about residential real estate that falls into a “-plex” category? Duplexes, triplexes, and fourplexes are a multi-family type of real estate with unique advantages and drawbacks. This article will:

- Define duplex, triplex, and fourplex real estate

- Explain what makes it different from commercial real estate multi-family units

- Why someone would buy a “-plex”

- The advantages of owning a “-plex”

- Buying a “-plex” property

- Financing for a “-plex” purchase

What qualifies as a duplex, triplex, or fourplex?

A single family home is designed as one building to contain one family. Legally, Realtor.com defines a single-family home as “a structure maintained and used as a single dwelling unit.” It is a stand-alone property with no shared walls or roofing. It does not share property with other dwellings, meaning it typically comes with a yard. It cannot share utilities with other homes and has its own private and direct access to a street or thoroughfare.

A duplex, triplex, and fourplex homes come in various shapes and configurations. The difference is the number of families the structure is designed to hold and how many dedicated entrances it has. The whole property parcel is deeded with two, three, or four living units.

A duplex refers to a properly designed for two separate families. Sometimes it is called a “twin home,” as sometimes the layouts are mirror images, but this is erroneous. A duplex is actually one building with two living units. The arrangement does not matter. The two units could be side by side or one on top of the other.

To qualify as a duplex, each unit must have a separate entrance, kitchen, bathroom, and utility meters. Each unit has the same amenities you’d find in a typical single-family home.

By extension, a triplex is a building with three separate living units and a fourplex or a quadplex has four separate living units.

As long as the homes are joined by some kind of common wall and roofing structure and it does not have five or more units, the property likely qualifies as a “-plex” configuration.

Isn’t a duplex, triplex, and fourplex commercial real estate?

Real estate professionals break the commercial real estate market into different submarkets: office, retail, medical, hospitality, industrial, and multi-family.

A duplex, triplex, and quadplex is technically multifamily real estate. It houses multiple families in a single building. For new multifamily real estate investors, owning a “-plex” is one of the most accessible forms of real estate. The reason why is the financing. It is possible to obtain a residential real estate loan for the purchase of these types of properties. Properties with five or more units require a commercial real estate loan. Additionally, owner-occupied properties have some exceptions when it comes to regulations about tenants and renting. Read about this in the Fair Housing Act and in Texas’ landlord laws.

Since duplex, triplex, and fourplex properties can be owner-occupied types of multifamily real estate and financed with a residential mortgage, we’re looking at them as residential real estate.

Why buy a duplex, triplex, or fourplex?

Most of the time, people considering buying a duplex, triplex or fourplex are interested in their investment potential. A few common ownership scenarios are:

- You, as the owner, live in one unit and rent the other unit(s). Depending on your down payment, the property may come with a higher monthly payment than a similar sized single family home. This is offset with the rental income. As a result of having a higher mortgage payment, you will build equity in the property faster. In some cases, it may be possible for you to live debt-free as your tenants’ rent payments cover the mortgage cost.

- You, as the owner, live in one unit. Your extended family lives in the other unit (s). This living scenario helps children to look after their aging parents or gives a couple’s younger adult children space and independence. Other scenario is extended families purchase the duplex together as a way to become homeowners and build equity.

- You, as an investor, buy the property and rent all the units. The “-plex: is solely an investment purchase. The consolidated properties reduce the overall cost of maintenance. Example: it’s much cheaper to replace the roof of one triplex than re-roofing three single family homes. The right purchase terms help the property become an income-producing asset in your real estate portfolio.

The Advantages of Duplexes, Triplexes, and Fourplexes

1. Affordable housing

For owners that choose to occupy one unit, housing becomes more affordable than a single-family home with similar square footage and available bedrooms. When the other unit(s) are occupied by renters, their monthly rent payments contribute towards your mortgage. For example, if your duplex monthly mortgage payment is $2,000, but you charge $1,100 to rent the other unit, you are financially responsible for $900 of the mortgage payment.

2. Keep family close

Millions of Americans are tackling rising healthcare costs, living expenses, and reduced retirement funding. How do adult children take care of their parents in the golden years of their lives without impacting their retirement? Some choose to allay these expenses through duplex and triplex living. The family members maintain a degree of independence, but help is next door when it’s needed. There's no drive across town to lend a hand.

This living arrangement is helpful for families with special needs, for those looking to help young adults just starting in their careers, retirement, and other situations.

3. Tax deductions

Certain deductions make a “-plex” property more affordable. You might be able to deduct home expenses for maintenance and yard work if a property unit is rented. One caveat: taxes for duplex, triplex, fourplex properties can be complicated. It's best to consult with a certified public accountant or tax professional experienced with this property type.

4. Location

Duplexes have some amenity benefits of a single-family home like a garage, a yard, and some privacy. Another advantage is their ability to house more people in a smaller location. The duplex/triplex/fourplex footprint allows the properties to be built closer to high-value locations. This might help position you close to work or amenities that matter to you for less than buying or renting a single-family home.

5. Your rules

The owner-occupied option means you set the rules when it comes to pets and smoking. It's easier to keep an eye on your property because you're living there. The tenants are encouraged to be on their best behavior because they know the landlord is next door.

The Drawbacks to Duplexes, Triplexes, and Fourplexes

1. The tenants next door

Owner-occupation has its upside and downside. Keeping a closer eye on your tenants also means the tenants can knock on your door anytime. You must be comfortable dealing with people. If you end up with a problem tenant who's constantly complaining, coming home could be far from relaxing. Be prepared to live with the sounds coming from next door.

2. Keeping units occupied

In the multifamily business, it's rare to have all your units fully occupied all months of the year. While having this space to rent helps offset your costs, never count on your units having paying tenants all the time. Finding new tenants can take some time if the market isn't ideal or the “-plex” property is not in an ideal location. And, if you’re forced to evict a problem tenant, you risk going months without that extra income stream as you work through the process and clean the damage left behind. This could leave you on the hook for the full mortgage payment.

3. The mortgage benefit

New investors or homeowners sometimes decide to buy because they’ve read about how the tenants pay your mortgage allowing “-plex” owners to live mortgage-free. Have you heard the cliche, “If it sounds too good to be true, it is?” The reality depends on the property’s fundamentals.

In an owner-occupied duplex property, you have only one unit for rent. If that unit is not occupied, you are responsible for 100 percent of the mortgage payment. In a triplex, you have two rental units available to offset the mortgage payment. In a quadplex, you have three other units available. So, the more units you have for rent, the greater your income potential.

Remember, the more living units, the higher the initial purchase price and your monthly mortgage. Let’s say your triplex property costs $1,900 a month. You rent the two units for $1,100 a month. When both are occupied, you have an income stream of $2,200, meaning the mortgage is covered and you have an additional $300. One vacant unit means you’re responsible for $800/month.

And what about expenses? Landscaping, maintenance, property improvements, and marketing will reduce your profit.

4. Down payment

It’s possible to use residential real estate programs to finance a duplex, triplex, or fourplex property. Be prepared for some stipulations, including the need for a down payment and caps on financing amounts. Every program is different, and mortgage rates are in flux. Anticipate needing a down payment anywhere from 5 to 25 percent depending on your situation, credit, and financing program.

5. Privacy

If you are a person who values your privacy, living in an owner-occupied “-plex” property means sharing walls and spaces with other people. You have to be comfortable dealing with their noise and their smells. As the landlord, you must be able to tackle conflict in a calm and courteous manner. There's no outside force stepping in.

6. Maintenance is your job

Regardless of how you choose to occupy the “-plex” property, you will be responsible for the maintenance unless you hire a property management company. Anything that breaks, including your tenant’s refrigerator or their HVAC, becomes your responsibility.

7. Fewer amenities

Multifamily properties like condominiums or apartment complexes attract and retain occupants with additional shared amenities, like a pool, tennis court, or fitness center. Chances are your duplex property won't have these extra shared amenities unless it’s part of a community managed by a greater homeowner’s association. That means paying HOA dues.

Purchasing duplex, triplex, or fourplex properties

A “-plex” property can be in a solid investment for investors and residential home buyers. It makes sense to have it as an owner-occupied property where you can generate some income–maybe even live mortgage-free– and take a step into investing in multi-unit properties. Investors look at “-plex” properties as a way to diversify their income stream and consolidate their maintenance expenses.

Purchasing a “-plex” property is similar to purchasing other types of residential real estate in that you want to assess the building's condition, its location, and hire a professional inspector. These are important for negotiating a fair purchase price.

Since this property has the potential to produce income for you, you need to take a few extra steps. This doesn’t matter if you plan to occupy a unit or rent all units. Approach the property like a business.

- Evaluate the numbers for the property, like its gross operating income, its vacancy rate, maintenance expenses, or anything else that could impact your bottom line. A high turnover rate will drive down your net operating income (NOI). Does the property have a high maintenance cost that drives down NOI?

- Location matters. Is the property in a desirable area? This increases your chances of keeping the property occupied and commanding solid rent rates. What are other duplexes, triplexes, or fourplexes asking for rent in the community around your considered property?

A real estate professional with experience in small multi-family properties can help with your market analysis and assessing the property’s value.

If you're debating between buying a duplex or fourplex, there are advantages and disadvantages to both scenarios. Most of it boils down to revenue and expenses. The more units you have, the more expenses, but also the more income to offset those expenses.

Before buying a duplex, triplex, or fourplex, it's worth learning about tenant management and how apartment buildings are run. Whether you choose to occupy a living unit or not, chances are high you will be renting out at least one unit. If this is your first time becoming a property investor and the landlord, learn about the Fair Housing Act and other local regulations that impact you.

As a landlord, you'll be responsible for screening tenants, negotiating and writing leases, maintaining their property in a livable condition, rent collection and other tasks. Be comfortable with the idea of evicting tenants. Have a plan in place well before you purchase a multiplex property.

Once you commit to purchasing a duplex, triplex, or fourplex, unless you plan to purchase all-cash, meet with lenders. Find a financing program that fits your individual situation. Get pre-qualified to know how much you can afford.

Searching for these properties can be tricky. Sometimes they list as residential real estate, and they can pop up on commercial real estate sites as multifamily properties. An experienced real estate professional knows where to source these properties and can leverage their network to find owners who might be interested in selling their units.

Financing a duplex, triplex, or fourplex

Properties with more than four units are considered commercial properties and will not qualify for conventional or government-backed financing.

You can get a conventional residential mortgage to purchase a duplex. Another option is to get an owner-occupied loan with a condition that you live on the property. You may be able to get owner-financing where you paid direct to the seller instead of the bank.

FHA and VA loans are issued for owner-occupied properties only. They may be available for 2-, 3-, or 4- unit properties as long as you live in one of the units.

You can finance a duplex, triplex, or fourplex as an investment or rental property only. However, they will be more difficult to finance.

Sometimes owners use the rental income to qualify for the loan. Typically, lenders want an existing signed lease agreement to verify the rental payments and two years’ rent history.

Real estate investors likely need a higher down payment to secure traditional financing. Banks consider these purchases to be higher risk; Bankrate estimates investor buyers will need 25 to 30 percent down to get the best interest rates.

Taxes on a duplex, triplex, or fourplex

Taxes on a “-plex” property are inherently more complex. For owner-occupied properties, you have the advantage of homeowner tax deductions like single family homes or condominiums. However, you also have the potential of other deductions if you are renting out the additional units. Potential adds complications. Every scenario is different, so your best option is to work with a tax professional or CPA. For starters, look at the IRS stipulations of rental properties and owner-occupied properties in their online guide.

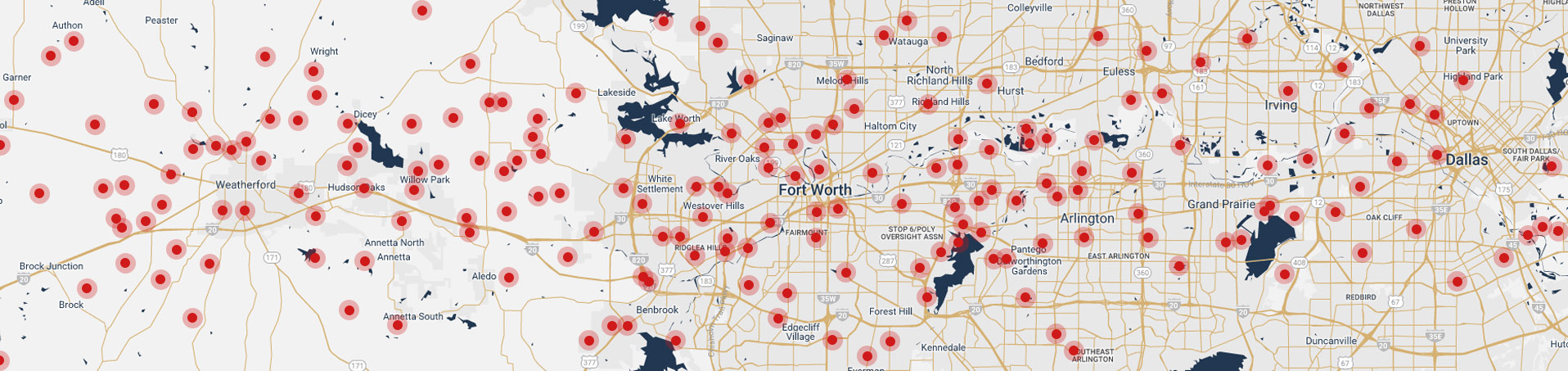

Finding Fort Worth duplex, triplex, and fourplexes

These types of properties are found all over Fort Worth. It's a matter of working with a real estate professional familiar with the different neighborhoods when purchasing multi-unit properties.

Where to look depends on your needs and wants. Duplexes near the campus of Texas Christian University make sense if you want to rent to the student market. Maybe you’d rather be closer to downtown for a work-play-live lifestyle. There's no limitations on where you can find a “-plex” property.

Chicotsky Real Estate Group helps buyers and sellers in neighborhoods across Fort Worth find the ideal properties for their needs. Our experience in residential and commercial real estate helps bridge the knowledge gaps in purchasing duplex, triplex, and fourplex properties for real estate owners and investors.