House or Condo: Deciding to Buy and The Process

Debating between buying a house or buying a condo? Your friends, family, and colleagues have probably told you different things about condominium living versus owning a single-family home. What’s right for you depends on your personal situation, housing wants, and future plans. This detailed guide covers everything you need to know when you're deciding between buying a house or buying a condo.

What’s the Difference Between a House and a Condo?

A single-family home is a detached residential structure that shares no walls or roofing structure with another housing unit. It sits on its separate defined property parcel. The amenities that come with the home are shared with no one else. The responsibility for upkeep lies in the owner. Townhomes, duplexes, triplexes, and fourplexes do not count in this definition.

A condominium is a multifamily living situation where each housing unit is privately owned by different people. The common areas, like parking lots and walkways, are collectively owned and managed by the condominium association. Stylistically, condos may look similar to apartments. A condominium can be a stand-alone building or part of an entire community.

Condo owners share the expenses of maintaining common areas with all unit owners. Think: landscaping, exterior upkeep, pool, fitness room, parking, et al. In a single-family home situation, the owner typically is in charge of all these expenses.

The exception is deed-restricted communities with a homeowner's association. These master-planned developments sometimes offer single-family homeowners shared amenities, like a clubhouse or athletic center, managed by the homeowner association (HOA). However, if the individual homeowner’s roof needs repair, that cost wouldn’t be shared with the other owners in the neighborhood like it would with a condo.

The Pros and Cons of House Living

Pro: Home appreciation

Real estate is an asset whose value grows over time, even when you factor in fluctuations to supply and demand. As long as you can invest the time into the property, chances are you will gain equity.

Since 1990, the Fort Worth appreciation rate has increased 122%. A home bought in 1990 for $100,000 today may be worth $222,000, as long as its condition has been maintained.

The news is good for short-term owners, too. Texas A&M University's Real Estate Center reports in the Fort Worth-Arlington Market, the home price index increased 4.8% year-over-year in the first quarter of 2019. Median prices rose from $222,000 to $232,500. The market has seen an upward trend for several quarters in a row.

Con: Variable gains

Appreciation gains are never guaranteed. If the real estate industry learned anything from the 2007 crash, it's that housing markets do wax and wane. The amount of gained equity when you choose to sell will depend on factors like your local neighborhood, current supply and demand, and the condition of your home. A poorly maintained home with serious structural damage will not be worth as much as the noted appreciation gains.

Pro: Tax deductions

Homeowners can deduct the interest on their mortgage payment from their federal taxes. You may be able to write off some home repairs or interest on home equity loans or lines of credit. When you sell the property, you may be exempt from capital gains tax as long as your home sale falls within these rules.

Con: All expenses are yours

As a single-family homeowner, the burden of repairs and upkeep falls on your shoulders. This is everything from the little stuff, like pest control, to big purchases like the HVAC system. Letting something like a roof leak slide can lead to even bigger problems that impact your home value.

Pro: Personalization

Home ownership allows you to explore your personal tastes. Owners outside deed-restricted communities can customize the property to fit their needs, within allowable city and county codes. Feel free to paint your house purple or orange, even if the color irritates your neighbors. Your house is your oyster.

Con: Limited supply

Housing demand is increasing as Millennials become first-time homebuyers. Certain price points have constricted supply of available homes. It may be challenging to find a home within your budget in the location you wish to live.

Pro: Room to grow

Single-family homes offer space to grow. Add a detached garage or workshop to pursue personal hobbies. Depending on the lot size, you may have room to make an addition to the home. Home with ample outdoor space give families with kids space to safely play and explore.

Con: Lack of community

Today’s communities are more isolated than in the past. Sometimes people don't even know the names of the people living next door.

Pro: No extra dues

It's your choice to live in a community with or without an HOA. Most single family homes do not have HOA dues. Those that do usually aren't extraordinarily expensive.

The Pros and Cons of a Condo

Pro: Affordable price points

For some buyers, a condo is a more affordable option to live in location they want when compared to a single-family home. Purchasing a condo can be a path to homeownership, especially in dense cities or popular vacation destination.

Con: Condos appreciate less

While condominium complexes do have appreciation gains, these are rates are less than a single-family home. Condo owners need to hold onto them longer to see the same equity gains.

Pro: Condos are a community

In a condominium building or complex, you're going to rub elbows with your neighbors. You'll see people in the walkways and in the common areas. It makes it easier to build relationships with others.

Con: Less privacy than a house

Not everyone is comfortable listening to the television playing in the unit next door. You'll grow closer to the people around you, but not everyone considers this a good thing.

Pro: Condos closer to dense locations

A condo complex is an easy way to fit more people in a confined property. Developers can fit multiple units on a lot, boosting their returns. The advantage for condo owners is they tend to be closer to shopping, entertainment, retail, and work compared to homeowners who choose to live in the suburbs for affordable housing.

Con: A smaller footprint

A condo tends to be less spacious than a single family home, although this is not the rule. Modern developments take into account layout in their property designs. Luxury condominium buildings have units upwards of two thousand square feet.

Pro: Easy to turn into an investment property

For real estate investors purchasing a condo as a vacation home, it's easy to turn the condo into an investment property. Rent it out when you're not living in it and produce income. Or, condo owners may choose to hold on to their condo when they move out and rent the space for income.

Con: Harder to sell

Condos are slightly harder to sell than single family homes. They'll spend more time on the market, partially because of the process, the condo association, and because the buyer pool is a little smaller.

Pro: Access to amenities

Condo complexes are all about wooing buyers using shared amenities. These run the gamut. Common amenities are swimming pools, fitness centers, and dog parks. An upscale condominium complex could have 24/7 concierge services, sauna rooms, business centers, and wine cellars.

Con: Pay monthly dues to the condo association

In addition to your monthly mortgage payment, condo owners are required to pay monthly dues to the condo association. These dues cover the maintenance and upkeep of the condo complex and pay for the shared amenities.

Pro: Less maintenance

The responsibility for the yard work and painting the exterior all falls to someone else when you live in a condo complex. That's more time for you to enjoy life and less time wasted painting fences.

Con: Condo Association

The condo association decides the fees, rules and regulations, and enforcement of the community. Some associations work great. Others leave a lot to be desired. A poorly managed condo association risks bankrupting the budget and leaving the condo owners facing “special assessments” for thousands of dollars for necessary repair costs.

Why Buy a House

Single-family home ownership is right for you if:

- You plan to stay in the location for a few years. Every neighborhood and market is different. Your best bet for gaining appreciation given current trends is between 3-5 years.

- You value privacy. While newer neighborhoods are being built with homes closer together, you still won't share walls with someone else. This affords you a modicum of solitude. Of course, the larger the lot, the more private it is.

- You want a yard for your family. It's understandable that you want space for your kids to ride around on their bikes and to dig in the dirt. Single family homes are a popular option with families.

- You don't mind the maintenance. Perhaps you enjoy hammering do-it-yourself projects. You enjoy serving fresh summer vegetables grown in your backyard garden.

- You need storage. Larger lots may have storage sheds, workshops, attics, and garages to keep your play gear. Not all condos have space for storing things like holiday decorations or bicycles.

Why Buy a Condo

- You are seeking an affordable second home. A condo is a way to live in a desirable location without busting your budget and saving some cost on necessary maintenance.

- You want to take your first step into home ownership. Condo living is a way to see if the responsibilities of ownership are right for you without diving headfirst into the deep end.

- You plan to stay in the property for five or more years. This will allow you to get the most of any market equity gains.

- You want to live in style without the responsibility. A pool alone is a huge maintenance responsibility. It's not just keeping it from turning green, must keep the pump maintained and the pH balance right. Condo living gives access to lifestyle upgrades without taking up room in your home and leaving you on the hook for keeping it working.

- You're committed to living in a certain neighborhood. Unfortunately, the local prices for single-family homes are beyond your budget. Purchasing into a condo is your way to live in the neighborhood.

What’s the Process Behind Buying a House

Essentially, the home-buying process follows these steps.

- Check your credit score. Mortgage lenders use your credit score to evaluate how much and what loans you qualify for. If your credit score is less than ideal, these reports give recommendations on how to increase your score and secure a better rate. Changing your score can take a few months, which is why it's important to check your credit score first.

- Look at your finances. Buying a home is a huge financial commitment. Most loan programs require some form of down payment. You’ll also be responsible for some closing costs, which can run a few thousand dollars. How much money do you have available for a down payment and closing? If the answer is not enough, create a budget to save this funding before you start house shopping. Additionally, knowing how much you can put down on your home influences your monthly mortgage payment and how much money lenders are willing to finance.

- Start mortgage shopping. Before you walk through the front door of your first home showing, talk to several mortgage lenders. Try some free online mortgage calculators to experiment with how much your down payment and mortgage interest rates influence your monthly payment. Meet with lenders to see what programs they have available and what you need for pre-qualification. Find the lender you're going to want to work with when you find your dream home. Mortgage lenders will tell you how much financing you qualify for. This is important for setting your price point.

- Hire a real estate agent. This is a certified professional with experience buying and selling residential real estate. Real estate agents are your best source of information about the local markets and homes available to you. Agents are your advocate from the moment you hire them. They’ll guide you from house hunting to closing the sale.

- Think seriously about what you want in your home. You need to identify your deal-breakers and your “nice to haves”. What are the things in a home you can compromise on? Talk with your real estate agent about your home buying checklist. They help temper your expectations with the reality of the neighborhoods you are looking in.

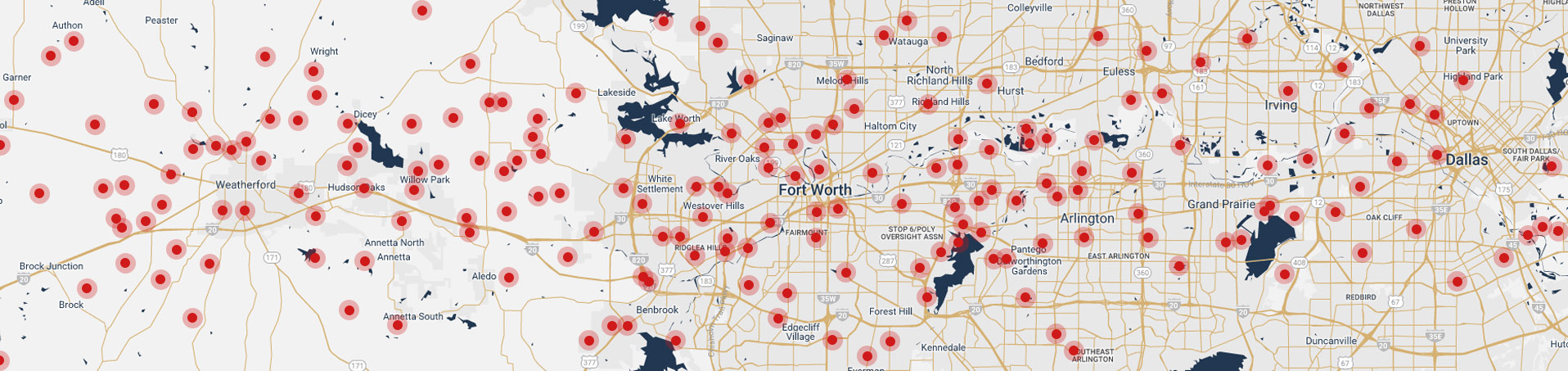

- Research the real estate market. Once you know how much financing you qualify for and how much you'd like to spend on your home every month, research the market. You need to know what's out there that fits within your budget. Again, your real estate agent has access to more information on hyperlocal markets than some of the online websites you may be tempted to check.

- Look at properties. Your real estate agent will guide you through the process of finding and touring available properties. Keep your schedule available, as sometimes they'll try to get you in the door first when they know something is coming on the market they think you'll like.

- Negotiate with the homeowner. After finding a property you want to put an offer on, you will submit a purchase contract to the homeowner. Different things can happen during negotiations. A real estate agent will guide you through this process. Expect some back and forth with the homeowner.

- Work through the pending phase. An accepted purchase agreement is not the end of the process. Usually several weeks pass between a purchase agreement signing and the actual closing of the sale. During this time, you'll have the home inspected, appraised, and finalize financing. There may be some counter negotiations depending on the results of the home inspection. Again, a real estate professional will be your guide through the pending phase.

- Close on the home sale. Just before you close on the property, you'll take a final walk-through to ensure everything in the home is in working order. After that, you'll go to closing. You'll pay the escrow fees and closing costs that are due at the closing table. The real estate deed will be transferred and you will become a homeowner.

What Makes Buying a Condo Different?

The condo buying process follows the same process as buying a home, but there are some additional steps and factors to consider.

- Speaking with lenders. Financial institutions have different requirements for lending funds towards a condo unit purchase. The lenders will tell you what they require in terms of paperwork and down payment. It can be harder to secure lending for a condo than for a single-family home.

- Factoring Condominium Association fees. Remember, you'll be paying condominium association fees in addition to a monthly mortgage payment. When you look at a condominium complex, ask about these fees and how their payments are scheduled. Keep the total cost within your monthly budget.

- Researching condo management. Look beyond the unit and at the greater community. It's important to buy into a well-managed condo complex with strong financial health. Meet with the community manager or the condo association president. Make sure your personalities gel. Look at documents that show how the condominium is governed. Examine the condo regulations to see what you can and can't do when you live there. Pay attention to how many owners are not paying their dues. If you can, get your hands on a copy of the condo association budget.

- Contingencies in the contract. In your purchase contract offer for a condo, you need to add some additional contingencies. This includes your ability to review the condominiums by laws and restrictions, budgets, and balance sheet. If things are not looking solid, this will give you a way to back out of the purchase agreement.

Ready to buy real estate?

Once you’ve made your decision to buy a house or to buy a condo, you'll need the best in Fort Worth real estate. Our Fort Worth realtor is experienced in Fort Worth’s many neighborhoods and all forms of residential real estate. If you're on the fence, we can guide you to making the right decision. We know one isn’t necessarily better than the other; it’s all about your needs.