The real estate market has been on fire for the last few years. The pandemic accelerated the desire for larger homes with outdoor spaces and a lower cost of living. Low interest rates and a desire for more space have driven buyers to purchase homes at a record pace.

However, the rapid sales pace was unlikely to continue. Recent changes in the market suggest that things may be cooling off. Mortgage rates are rising, inflation worries loom, inventory is increasing, and some buyers are having second thoughts about their purchase plans.

So, what does this changing market mean for your real estate goals?

Since higher interest rates make borrowing money for a home purchase more expensive, some buyers could put their plans on hold to wait for rates to come back down. Those planning to sell their homes and move to a larger or more expensive property may opt to stay put, reducing the available inventory for smaller, more affordable homes.

In a May 2022 National Association of Realtors report, Chief Economist Lawerence Yun described the current conditions as a "housing recession." That doesn't mean a drop in home prices but rather a decline in home sales and new construction.

Let's look at what could happen to the market from various perspectives.

A changing market and home buyers

In August 2021, home buyers faced a market with record-low inventory. The most competitive homes could go under contract within days of coming on the market, often with multiple offers. Buyers were waiving contingencies and sweetening the deal by paying over the list price. Home sales were high and tempered only by constrained supply.

A year later, home sales are down. In July, sales of preexisting homes declined 5.9% from the month prior. This is the sixth month in a row with a decrease. Comparatively, it was a 20% decline from this time last year.

Sales being down is more a result of inventory. The number of homes for sale remains constricted, and as a result, prices keep going up. Nationally, nearly 40% of homes still receive the full list price. The country's median list price in July 2022 was $403,800, up 10.8% from July 2021.

Across Texas, the housing market continues to cool as sales volume declines and housing inventories rise. In June 2022, over 37,000 homes sold in the state, 9.4% below June 2021 sales. The slowdown began in January, but June had the most notable dip. The days on the market is also increasing but often remain under a month.

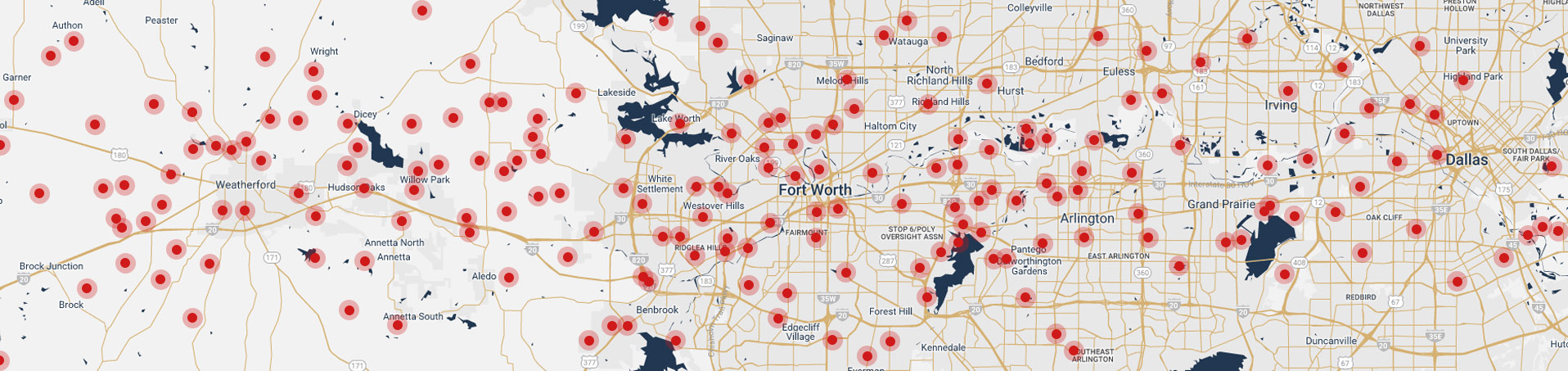

Looking closer at the Fort Worth residential real estate market, the Greater Fort Worth Association of Realtors (GWFAR) reported in July 2022 that residential home sales had an average price of $355,000, an 18% increase over the prior year. However, the figure was less than in May and June.

Analysis from Briggs Freeman Sotheby's showed 10% fewer homes sold in Q2 2022 compared to Q2 2021 in Tarrant County. However, the 12-month median selling price was up 22%.

Supply and demand vary based on price point. Analyzing the price ranges in the report, local inventory in the 0-$300K price bracket was only 474 homes in Q2 2022, partly because there was a 60% reduction in available units. The $300-$500K bracket had 1,650 listings and a 30% growth in inventory. While it had the highest inventory, the $500-$700K price range also had the most closed sales.

Fort Worth's overall inventory was down 9% in Q2 2022, but the median selling price was up 22%. Only Westover Hills had a decline in median sale prices, but it also sold only one home compared to four homes in Q2 2021. Crestwood and Riverhills had the highest leaps in median sale prices, up 52% and 50%, respectively.

Mortgage interests are now the dominating story for home buyers, more so than the limited supply of homes. Buyers are experiencing more challenges qualifying for financing or affording higher monthly payments. Interest rates are nearly double where they were from February 2022 to August 2022.

Remember that today's 30-year mortgage rates are still below average from a historical perspective. From April 1971 to June 2022, the 30-year fixed-mortgage rate averaged 7.7%. Current Texas rates average around 5.78%.

However, seeing how interest rates were at or below 3% in 2021, the current higher rates could lead to slower sales in the short term.

Still, if you're considering buying a home, now is a good time. Prices will likely continue to rise, but at a slower pace than we've seen in recent months. And, with interest rates still near historic lows, now is a great time to lock in a low rate.

On the upside, inventory is increasing, reaching its highest level nationally since August 2020. And while prices are rising, the pace of the increases is slowing down. More inventory and less competition mean current buyers are less likely to encounter multiple offer situations as more potential buyers opt to delay their purchasing decisions.

GWFAR reported the July 2022 inventory at 1.9 months in Fort Worth and Tarrant County, which is 0.6 months longer than July 2021. Active listings were also up 40%.

Contingencies are returning to the table. Gone are the days when offers free of inspections, home warranties, and leasebacks were strategies to make a purchase offer more competitive. Fewer buyers need to offer funds over the list price to win a home.

Chances are high that the market is heading towards a more balanced state. However, the composition of the market remains a sticking point. Lower price points remain highly competitive for first-time home buyers or those seeking a bargain.

If you're considering buying a home, it's still a good time to do so, especially if you plan to live in the home for several years. The interest rate on a home is lower over time than the inflation rate. In fact, owning real estate can be a solid hedge against inflation. An economics professor at Yale found that since 1928, real estate had an annualized return of 4.2% compared to the annualized inflation rate of 3.08%.

You'll also benefit from building equity, long-term appreciation, and tax benefits.

If you find the interest rate high, you could lock it in now and possibly refinance to a better rate in the future. Lock in a low-interest rate now before rates go up any further.

And if you're waiting for a potential market crash to buy a deal, the current market conditions are not like 2008. The underwritten mortgages are in a stronger position today, and there are more checks and balances in the system. Given that a crash happens when there are far more sellers than buyers, and we are likely to be in a seller's market for some time, it's unlikely that a full-scale housing market crash will occur.

A changing market and new construction

New construction home sales were soaring early in 2022 as home builders jumped to meet demand. February new home starts were 6.8% nationwide, the fastest growth rate since 2006. Home builders had wait lists and commanded top pricing.

In Tarrant County, April 2022 reported 1,300 building permits, one of the highest amounts in recent years.

Fast forward six months. Demand for new homes cooled significantly due to rising inflation and interest rates. Home builders across the Sun Belt startedslashing prices and negotiating with new home buyers. Inflation impacts the pricing they can offer as material and labor costs rise.

In Texas, the number of monthly permits for single-family construction fell below 15,000, a 5.2% decline from the previous quarter. Building permits in Austin and Houston dropped significantly.

Despite this decrease, Houston and DFW were still the top two metropolitan areas on the national permit list due to each having a seasonally adjusted rate of over 4,000 new-structure buildings or existing-structure renovation permits. Data from Zonda said that Dallas had the most housing starts and luxury home construction projects during Q2 2022.

Still, local home builders will likely pull back new housing starts to match actual demand better, leading to reduced housing inventory.

A changing market and home sellers

As a home seller, naturally, you want to command top dollar for your home. Sellers have been in the driver's seat for months, expecting multiple offers, favorable contingencies, and robust offers.

The late 2022 reality is that home sellers listing now need to adjust their pricing expectations. It's better to price your home competitively to sell. Sellers listing too high is finding they need to make price adjustments. Homes are less likely to have multiple purchase offers, offers with few contingencies, and above-list prices.

Remember, the average list price in Fort Worth in July 2022 was $355,000, which might have been an 18% increase over July 2021, but was less than May and June 2022.

Patience is also key as the days on the market begin to increase. Texas' average reached 34 days, up from 28 in March 2022. In Fort Worth, GWFAR reported an average of 18 days on the market.

If the home is priced right, requires little repair work, and is in a desirable location, it will sell, but it will take some time. This midyear review chart from Briggs Freeman Sotheby's breaks down the Q2 2022 sale prices by Fort Worth and its key communities. It provides some general insight into how homes around you may be priced to sell.

With more homes on the market, buyers have more options and may be less willing to pay top dollar for a property. And, facing higher interest rates, more buyers are canceling contracts because they find the lender's payment schedules unacceptable. Some can no longer qualify for financing. Many are taking a wait-and-see approach regarding the market unpredictably and their future housing plans.

According to NAR Chief Economist Lawerence Yun, the good news is that "homeowners are in a very comfortable position financially, in terms of their housing wealth." While the overall economy is lining up for a recession, homeownership is not in a recession. Median home prices are still rising because of the low supply of existing and new construction homes.

You may want to wait a bit longer if you're considering selling. The market is still favorable for sellers, but more buyers are backing out of sales due to financing issues. If you can wait to sell, you may be able to get a higher price later on once recession fears ease and interest rates stabilize.

However, it's not necessarily the wrong time to sell. Prices are high, and there is still strong demand for properties. Fort Worth is very much a seller's market, with 1.9 months' supply. A well-maintained home is likely to command at or near top dollar.

Do be prepared to adjust your pricing expectations. With more homes on the market and rising interest rates, buyers have more options and may be less willing to pay top dollar for a property. They likely will want some contingencies back, like the home inspection or a warranty. Days on the market are likely to increase, but in the near term will still be low.

The Real Estate Market

No matter your real estate goals, it's important to stay up-to-date on the latest market trends. By understanding how the market is changing, you can make the best decisions for your unique situation.

Now is a good time to buy or sell a home, but be aware the market is constantly evolving. The Chicotsky Real Estate Group stays on top of real estate and economic trends to paint the most accurate picture possible of Fort Worth real estate. Feel free to ask for a market update and how it's impacting your purchasing or selling decisions.