With Fort Worth real estate enjoying one of the best years since the Great Recession, 2022 is wrapping up with big changes. Increased uncertainty has spread across the country due to overarching economic shifts and predictions of recession. Looking at the national news, you'd expect the Fort Worth real estate market to hit the brakes for 2023, but is that the case?

Dallas-Fort Worth has been ranked number two on a recent report of the hottest housing markets in 2022. Experts expect a smaller cooling effect here in 2023 than in other parts of the country. While it's useful to look at national trends, it's information like this that proves it's essential to look at real estate performance locally.

Is Fort Worth the right place to buy or sell real estate in 2023? Let's break down the current real estate market, key economic indicators, and potential future Fort Worth real estate trends for 2023.

How has the real estate market been performing?

Fort Worth started the year in a bull market, with January clocking in a record-low inventory of 0.7 months. Home prices were up 25% year-over-year. The trend of year-over-year double-digit median price increases and low inventory continued through the spring when the market started a slow shift in response to greater economic conditions.

List price growth moderates

Let's remember that what we have been experiencing is unprecedented. Real estate is cyclical. At some point, the market had to correct. What we saw through the summer, fall, and now early winter is a move toward that correction. Over the last five years, the median home price in the Fort Worth-Arlington metro has grown from $185,000 to $295,000, based on Texas A&M Real Estate Center (TAMU) data.

Looking at a month-to-month basis, home price growth does show moderation. In April 2022, the median home price was $350,000. The median home in Tarrant County sold for $341,000 in October 2022 (the most recent data as of drafting this article), a 10% increase from the previous year.

According to TAMU, homes priced in the $400s and up made up 58.4% of single-family new construction sales in the past year. This is compared to the second most popular price range, homes in the $300s, which has fallen from 37.4% of stock last year to only 30.6%.

Sellers concerned about losing value shouldn't be too concerned. While price growth is declining, overall home prices don't look like they'll drop significantly anytime soon — especially with our larger-than-average home size.

Inventory increases, but still low

Home prices have been pushed upward by lower inventory. Even though October's inventory increased 92% year over year, remember it was historically low to begin with. Total listings were down 42% over the last five years.

Source: Texas A&M University Real Estate Center, November 2020

Looking at TAMU data, you can see the months' supply of inventory growing throughout 2022 as price growth moderates. By October, the supply stood at 2.1 months.

After historically low listings, the market has nowhere to go but up. That's why active residential property listings in the metro area increased by over 73% to 7,161 this year. The number of available homes in the third quarter of 2022 was up 82.1% from the previous year, coming in at 2.4 months' supply.

The market in 2020-2021 saw incredible demand and sales activity. The 2022 market has been equally volatile, but in a way that is shifting the market back towards balance after months of record-setting real estate activity.

Yes, inventory is rising, but it's still historically low. Fort Worth is still a seller's market, although the days of multiple offers well above list price have cooled in the face of inflation and rising mortgage rates. Median prices are rising because there is still strong buyer demand.

The verdict? Fort Worth appears to be ending 2022 relatively stable and bullish compared to other markets.

How's the future shaping up?

To forecast if the Fort Worth real estate market will remain strong in 2023 depends on numerous economic factors combined with housing data. The contributing conditions:

Mortgage rates

Prospective buyers are keeping a close eye on mortgage rates. According to Freddie Mac's November 10, 2022 report, the 30-year fixed-rate mortgage averaged 7.08%, over three points higher than the same time the prior year.

Based on the median price data at that time, buying a typical for-sale existing home with 10% down would cost nearly $1,140 more per month compared to last year's rate.

Mortgage rates are not expected to drop any time soon, although many experts think they will moderate in mid-2023, most likely somewhere in the 6-7% range.

Inflation

The Federal Reserve's moves to tamper inflation and a pending recession raised the base rate by 3 points from June 2022-November 2022. While its rates don't directly impact mortgage-backed securities, it trickles across the economy when the Fed's rates go up.

In November 2022, the overall inflation rate was 7.8%, down from the September high of 8.2%. Inflation reduces a homebuyer's or home builder's power against the dollar. We can expect to pay more for building materials, tools, and other items associated with buying or building a Fort Worth home. Not to mention the cost of all goods and services increases, reducing the funds a buyer has available to buy a home.

Housing Inventory

With 6.5 months of inventory considered a balanced market, Fort Worth is far from balanced in terms of supply and demand. The Greater Fort Worth Association of Realtors (GFWAR) reported October 2022 inventory was 2.3 months, which was 1.7 months more than the historic low of 0.6 months reported in February. Homes spent an average of 35 days on the market, a nine-day jump year-over-year.

There are still buyers and sellers who need to move for various reasons. Active listings were up 92% in October, so buyers have more options available. Still, listings are low, so Fort Worth remains a seller's market.

Housing starts equally impact the housing inventory. Home builders had scaled back after the Great Recession, and new permits were still below demand even before the COVID-19 pandemic accelerated housing demand. Increased mortgage rates and inflation are tampering with buyer demand, so DFW housing starts have dropped 34% in Q3 2022, further reducing the available housing.

Trends to watch that impact real estate in 2023

The Urban Land Institute 2023 Emerging Trends report predicts that the real estate market in Dallas-Fort Worth will be booming in 2023. That forecast was based on the current solid fundamentals of DFW real estate and our overall economy. That said, a few areas could influence how our market performs in 2023.

Work from home vs. work from office

The work-from-home shift sparked during the pandemic has created a unique situation for Fort Worth real estate. Employers who previously demanded that employees work in the office now have to consider whether they should move back, especially if their workforce lives outside Fort Worth and commuting becomes an issue.

If the push is more work-from-office, the move out to suburbs seeking more space for working from home may ebb. Professionals may seek housing closer to the urban cores again to meet their commuting needs.

Job market growth

The Fort Worth job market stabilized in thethird quarter of 2022. Even though new job growth dipped in September, the market is still up 5.7% compared to last year. The pace of change has moderated from 4.9% in the first quarter to 3.9% in the third quarter, but it remains above average for Fort Worth-Arlington metro area standards.

Transportation, warehousing, leisure, and hospitality, are top-hiring industries.

Looking ahead, manufacturing growth is seeing signs of slowing down. Manufacturers are also busy attending to a backlog of previous orders, but new orders have been slowing down, as per the Dallas Fed's Manufacturing Outlook Survey. Experts say when manufacturing slows, the service industry typically follows.

Potential recession

The Fort Worth real estate market has been resilient thus far due largely to its diversified economy and the job market. But with most experts saying a 2023 recession is imminent, Fort Worth's housing market could take a hit if employers cut back hiring or consumers become reluctant to spend.

On the positive side, the general feeling is that this recession won't be like the 2008 economic downturn. For one, the factors are different. In 2008, predatory lending practices and the subprime mortgage crisis directly contributed to that recession. This time the housing market is in a stronger position with undersupply and high demand.

Interest rates

For 2023, interest rates are likely to be the big story. The Federal Reserve has signaled it will continue to raise rates to combat inflation, but at some point, efforts should moderate.

Various economic and real estate experts interviewed by Bankrate agreed the mortgage rates would likely peak between 7-8% in early 2023 and then slowly moderate downward to stabilize around 6-7%.

The key to the timing and extent of the mortgage rate peak will be if the Fed continues to raise interest rates in December 2022 and early 2023.

Normalizing markets

As Fort Worth's economy adjusts, markets are continuing the path back to "normal," using pre-pandemic numbers as a benchmark.

Homes are still selling, but the pace is slowing down. Competitively priced homes aren't going under contract days after listing but a few weeks. Price growth is still happening but at a less breakneck rate. Sales are still happening, but at more healthy levels compared to the last two years.

Real estate market watchers anticipate a drop in sales as high as 10% and maybe even more in specific overpriced markets.

Housing affordability

The Fort Worth real estate market still has challenges when it comes to housing affordability. According to the National Association of Realtors, affordability has reached its lowest levels across the nation in 30 years, with higher interest rates and fewer housing starts. While wages have grown, they lag behind the mortgage payments necessary to buy a home in Fort Worth.

Home values

Despite these challenges, Fort Worth's housing market is expected to report home value growth. While homeowners may not see the double-digit gains of the prior two years, they won't necessarily lose much appreciation. This is mainly due in part to a lack of inventory that has been caused by the pandemic.

How much home values will grow over 2023 has not been agreed upon, with some predicting only a 1% growth while others feel it will be 4-6%. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), said that home prices will not grow in 2023, although he noted Southern states are likely to fare better because of in-migration.

Areas to watch

People still want to live inside the I-820 Loop, even with the recent pandemic causing more people to work from home. This makes desirable neighborhoods like Tanglewood, Arlington Heights, and Fairmount competitive.

All three of these neighborhoods are primarily residential suburban houses, but with a perfect location for families or single millennials who want to be close to the city center.

If you're looking for an area that might grow in value, check out Linwood. Part of the Foundry District, it feels quiet and hidden away despite its location in Fort Worth. In recent years, new construction means it's not uncommon to see contemporary townhomes and historic cottages.

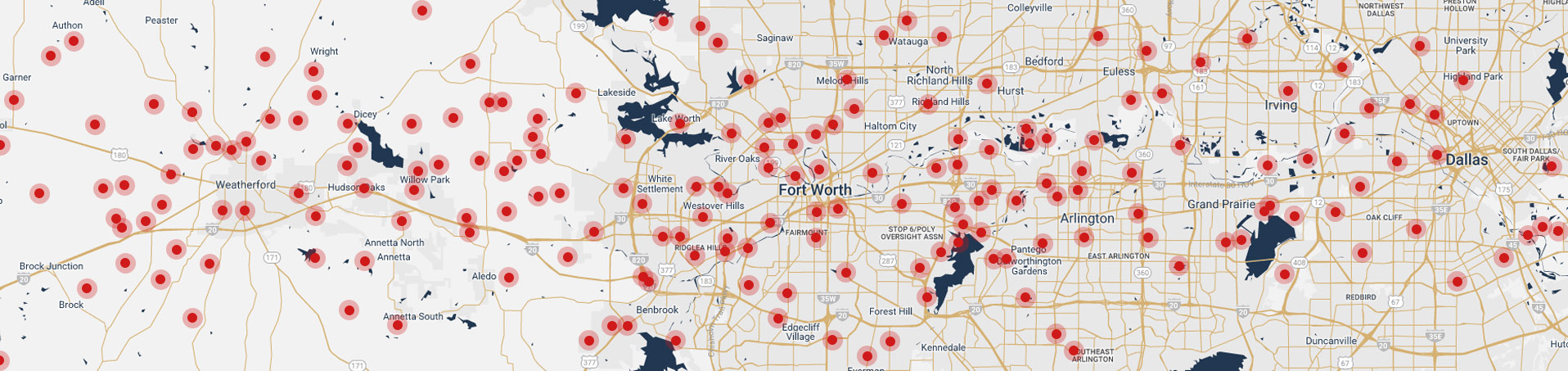

The most active areas in Tarrant County have primarily been in the south, around Midlothian, Mansfield, and Burleson, as buyers seek more affordable housing. These zip codes all had a median price of or under $500,000.

Meadows West is one such high-demand neighborhood. The neighborhood is centrally located between Oakmont Park and Cityview Park, boasting an entrance to the Fort Worth Bike Trails. The Trinity River runs parallel to Meadows West, providing residents with easy access to outdoor recreation.

Eagle Mountain, Saginaw, and Pecan Acres have also reported high activity and buyer interest. Far North Fort Worth, around Alliance Texas, was another top-five area for buyer interest as homes had more extensive square footage for the median price.

Fort Worth real estate in 2023

Only time will tell how Fort Worth's real estate market handles the changes coming in 2023, but it looks like a safe bet for now. Based on economic factors and buyer demand, Fort Worth's housing market is expected to experience modest growth in 2023. Compared to other parts of the country, the city remains a safe bet for buying or selling in the new year.

Having a real estate professional you trust is key to navigating the shifting scene. If you have any questions about Fort Worth's real estate market, rely on Chicotsky Real Estate Group's experience and local knowledge for the latest information.