Our state legislature levies a lot of power in how we manage and transact real estate. As real estate professionals, it's our duty to stay on top of relevant changes that impact our clients. The most recent Texas legislature adjourned on May 27th and passed some rather significant changes. Legislators lobbied and successfully had the government sign bills on a range of topics from widespread property tax reform to tenant late fees. Here are some of the most important changes you need to know about.

Texas property tax reform

The most monumental change during the 86th Texas legislature was the reform of the property tax system, specifically regarding the rollback tax rate.

Texas property tax units calculate two taxes: the effective tax rate and the rollback tax rate. The latter is a calculated maximum tax rate allowed without voter approval. Taxing units may increase their rollback tax rate for maintenance and operational funds (M&O) to pay for facilities, devices, or methods that reduce pollution and paying debt services.

The last time the rate was adjusted was when Ronald Reagan served as President. That means the rollback tax rate has been at 8 percent for over 40 years.

The passage and the signing of Senate Bill 2, also known as the Property Tax Reform and Relief Act of 2019, means the newly named “no-new-revenue” tax rate for cities, counties, and special districts is 3.5 percent, and it rolls backs the property taxes to 2.5 percent for school districts.

If the rollback rate exceeds the thresholds of 3.5 percent for cities and counties and 2.5 percent for school districts, it requires voter approval.

Additionally, the recent property tax reform:

- Allows the rollback rate to stay at 8 percent for special taxing units like hospital districts, cities or counties with a population under 30,000, and junior colleges.

- Requires more transparency for taxpayers with the creation of an online database. This database shows owners how the tax rate changes impact their bills. Additionally, it provides information about when and where a property owner’s local taxing entities are holding hearings to set tax rates.

Signed June 12 by Governor Greg Abbot, said in a statement, “Tonight, the Texas Legislature took a meaningful step in reinforcing private property rights by reining in the power of local taxing entities, providing more transparency to the property tax process, and enacting long-awaited appraisal reforms.”

Opponents to the bill worry about the financial impact on municipalities.

Texas school finance reform

House Bill 3, also known as the Texas Plan for Transformational School Finance Reform, promised a big boost to the state’s public education system. It's paired with Senate Bill 2. Half of the change is the new Tax Reduction and Excellence in Education Fund, which transforms the state's Public School finance and property tax system. The fund allocates around $6.5 billion in new public education spending while lowering Texan property tax bills by $5.1 billion.

The changes mean for the 2019-2020 year, most Texans will see an average eight-cent tax rate reduction. The following year, the reduction increases to 13 cents. The Star-Telegram points out a Fort Worth homeowner with a property valued at $200,000 would save $140 next year and $227.50 in 2021.

This reform would not be possible without the state increasing its share of education funding by seven percent to 45 percent. The funding is planned to come from sales tax revenue from the Wayfair Court Decision and severance tax revenue diversion as provided by the Texas Constitution.

Texas REALTORS® Chairman Tray Bates said in a press release, “We are pleased to see the state’s increased investment in teachers and classrooms, coupled with transparent property tax notifications and automatic rollback tax-rate elections. We thank our state leaders for delivering substantial reforms that benefit all property taxpayers.”

Ending forced annexation statewide

Until the passage of House Bill 347, most Texans could have their properties annexed into a municipality without their consent. This move was illegal in only 16 of Texas’ 254 counties.

Now, forced annexation is illegal statewide. If a municipality wishes to annex an area into its city limits, it must hold an election for those affected owners.

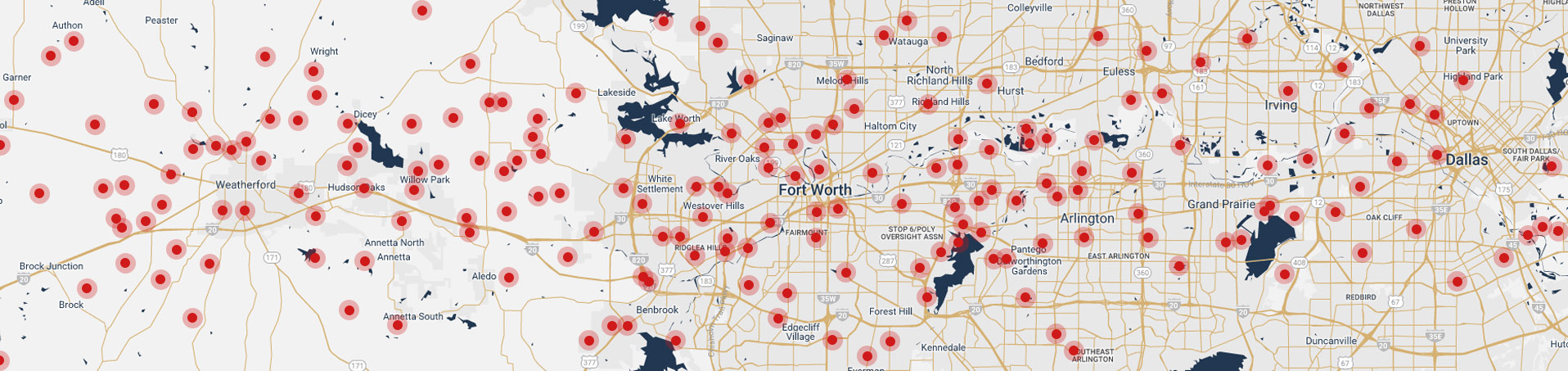

The City of Fort Worth maintains a yearly updated document on annexation proposals. You can see which areas the city had under consideration for annexation in through five-year periods. Please note that those these areas are “under consideration,” the city is not obligated to follow-though to annex in that area. The city could as easily propose to annex an area not listed in its documents.

The legislation went into effect upon the Governor’s signature, May 24, 2019.

Expanded access to home equity

Homeowners tap into the home equity and lines of credit for all sorts of reasons: home renovations, paying off large bills, or securing short-term funding.

Texas has always had a strong regulatory system to protect consumers from fraud and poor financial decisions. The state didn’t allow home equity loans until 1997. Even now, limitations on home equity loan sizes prevent owners from taking on undue risk and to curtail predatory lenders. Some of these restrictions include:

- Borrowers may only take out one home equity loan a year, even if the loan is paid off before that time is up.

- Home equity loans cannot close until at least 12 days after the borrower applies.

One thing about Texas is our wealth of agricultural land. House Bill 1254 allows owners to use their agricultural land as collateral for a home equity loan.

The new legislation takes effect Jan. 1, 2020.

Protecting property owners from excessive taxes

Taxation was an overarching theme in this session’s legislature. Another big victory was the change-of-use lookback taxes. This change will benefit property developers and those selling agricultural lands.

Under the previous law, when land use changed from agricultural classification to non-agricultural, the county’s chief appraiser was able to assess the owners five-years’ of back-taxes based on the new classification plus an additional seven percent interest per year.

The new law, House Bill 1743, changes the retroactive period to three years and reduces due interest to five percent.

The legislation takes effect on September 1, 2019.

Legislation on building materials

One of the more controversial changes, House Bill 1254 is intended to stop government entities, like cities and counties, from requiring the use of certain building methods, products, or materials in construction or any structure, residential or commercial not written into the national model code within the last three years.

Detractors believe the new law impacts local governing bodies’ ability to designate planned and conservation districts and their related aesthetic standards.

Advocates say the new limitation on building material requirements above the national standards will help reduce new construction costs. They claim some existing mandates favor certain vendors.

The legislation takes effect on January 1, 2020.

Enhanced seller’s disclosure

The required seller’s disclosure is how buyers and sellers cover all their bases when transacting properties. No buyer wants to purchase a home or commercial building only to discover serious problems that the seller knew about. It’s about enhancing transparency in the real estate process.

The update to the seller’s disclosure requirements as detailed in Senate Bill 339 continues to protect sellers and buyers. Disclosures now add pertinent information regarding flooding. Buyers will have in-depth information about past flooding on a property and its structures. Details will be required regarding floodplains, flood pools, floodways, or reservoirs.

It additionally puts in place a need to disclose potential aircraft noise and other activities from nearby military installations. This information is available in the most recent Air Installation Compatible Use Zone Study or Joint Land Use Study, found the military installation’s website or its county/municipality.

The closest military base to Fort Worth is the Naval Air Station Fort Worth Joint Reserve Base. This base hosts Navy, Marine Corps, Air Force, Army, and Texas Air National Guard units. Located just north of Westover Hills, properties in the surrounding area fall under this new requirement.

The new disclosure requirements begin on September 1, 2019.

Tenant Late Fees

For multifamily owners and their tenants, the new legislation under Senate Bill 1414 clarifies the parameters around fees assessed for late rent payments.

The new legislation says the assessed late fees must be considered “reasonable” and it gives a definition of what reasonable is:

- For a structure with less than four dwelling units, 12 percent of the amount of rent for the rental period under the lease

- For a structure with more than four dwelling units, ten percent of the amount of rent for the rental period under the lease

There are additional changes to the various sections of the law. Tenants have an additional one-day grace period before late fees can be charged, but leaves in place the law requiring late fees to be reasonable.

It also “creates a set of fees that constitute a “safe harbor,” as well as allowing flexibility for owners and managers who experience higher costs associated with collecting late rent,” says the Texas Apartment Association.

The full text with notated changes is readable here.

The new structure goes into effect on September 1, 2019.

Legislation going to a vote

When voters head to the polling stations this November, there will be two constitutional amendments related to real estate for their consideration. Both of these address recovery from natural disasters. With what our state has faced in the last few years, these bills are relevant to the times.

- House Joint Resolution 34 allows the legislature to enact a law providing for a temporary property tax exemption for qualified properties following a disaster. The ballot language is, “The constitutional amendment authorizing the legislature to provide for a temporary exemption from ad valorem taxation of a portion of the appraised value of certain property damaged by a disaster.”

- House Joint Resolution 4 creates a $1.7 billion fund to aid flood mitigation projects. The ballot language is, “The constitutional amendment providing for the creation of the flood infrastructure fund to assist in the financing of drainage, flood mitigation, and flood control projects.”

Real estate law and its impact on you

As you can see, the Texas legislature passed several relevant changes that impact home buyers and sellers in the immediate future. Our Fort Worth Realty Company tracks what bills matter to our clients. Small details, like the update to the seller’s disclosure, are important to us because we take our mission to represent our clients within the letter of the law seriously. You can rest assured when you work with us, you’re choosing the most informed real estate professionals in the business.